View/download full data on UK institutions’ finances, 2015-16

In what was probably its last annual report on the financial state of English universities before it morphs into the Office for Students, the Higher Education Funding Council for England did not pull any punches about the years ahead.

Given Brexit, challenges to student recruitment and cost pressures such as a rising pensions bill, the report, published in March and based on 2015-16 financial results, regards “the financial projections from some institutions in July 2016 as over-confident”. A relatively “sound” financial position overall, it warned, was obscuring a noticeable minority of universities with serious challenges.

These words did not go unnoticed by those who keep a close eye on the financial sustainability of universities. For Julie Mercer, global head of education at professional services firm Deloitte, the report was “one of the strongest warnings on the future finances for the sector that I have read” and represented “a step change” in Hefce’s “language and tone”.

So how have we reached this point? After all, some critics of UK universities claim that the trebling of fees to £9,000 in 2012 was a cash windfall for higher education: a point underlying the recently revived debates over the merits of fees and vice-chancellors’ pay levels. Lord Adonis, the former Labour education minister, for example, claimed in July that the current fees policy gave vice-chancellors “a licence to print money and pay themselves £400,000 salaries”.

To probe this issue, Times Higher Education, with the help of accountants Grant Thornton, has analysed UK universities’ 2015-16 financial data, provided by the Higher Education Statistics Agency. Although comparisons using some of the data are more difficult this year owing to new accounting standards, the picture that emerges is one of a sector as deeply divided, in financial terms, as many other sections of UK society.

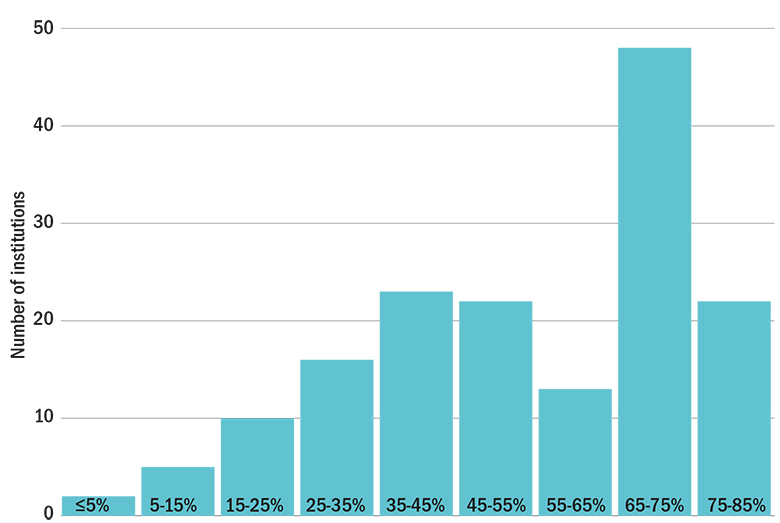

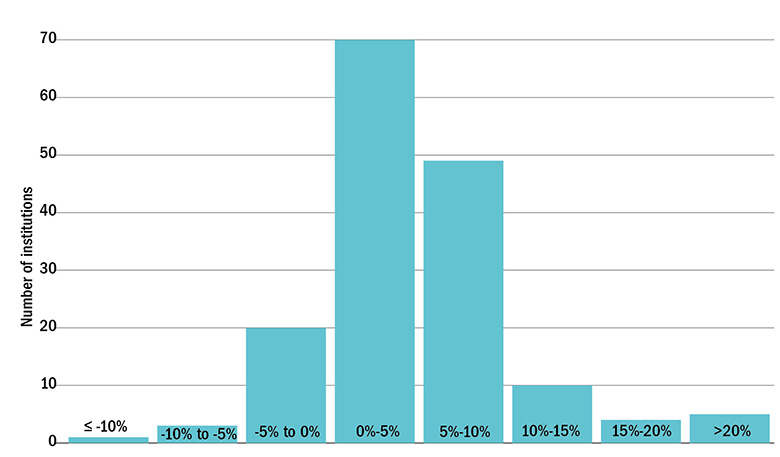

In England, much of this divide can be attributed to success or failure in the market for students, fully unleashed in 2015-16 with the ending of caps on undergraduate numbers. This is because income from tuition fees and education contracts accounted, on average, for just under half (48.4 per cent) of UK institutions’ total income, tipping over 50 per cent if you exclude Scotland’s fee-free system. But when you look at individual institutions, the picture is ever starker. Fees accounted for more than two-thirds of total income at 42 per cent of UK universities, while 22 institutions depended on fees for more than three-quarters of their income in 2015-16.

Tuition fees as a proportion of total income

Source: Hesa

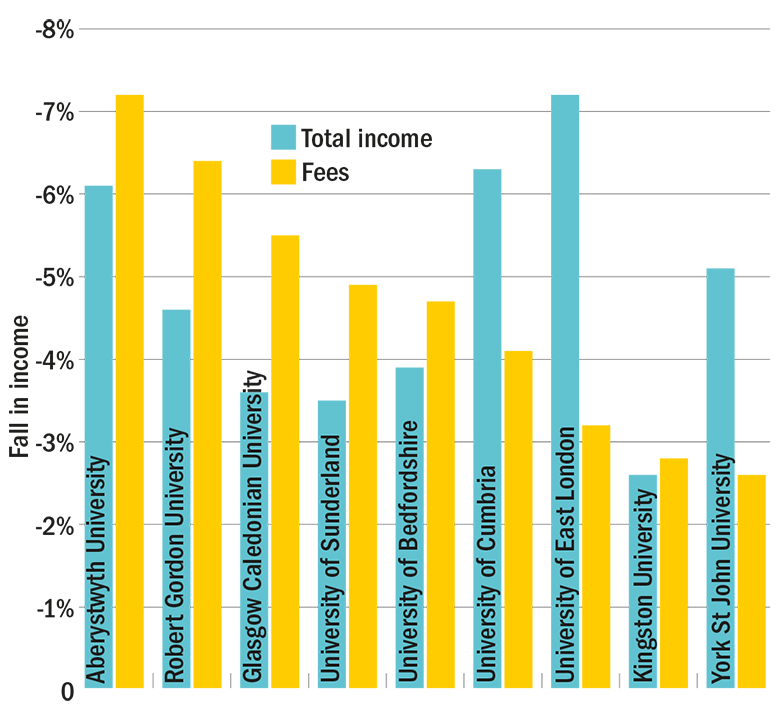

The risks of this are obvious: a sudden drop in student demand, even spread over a few years, could be catastrophic: a peril highlighted by the strong correlation that now exists between changes in real-terms income for universities and real-terms income from fees.

Institutions seeing at least a 2 per cent fall in real-terms fee and total income, 2014-15 to 2015-16

Source: Hesa

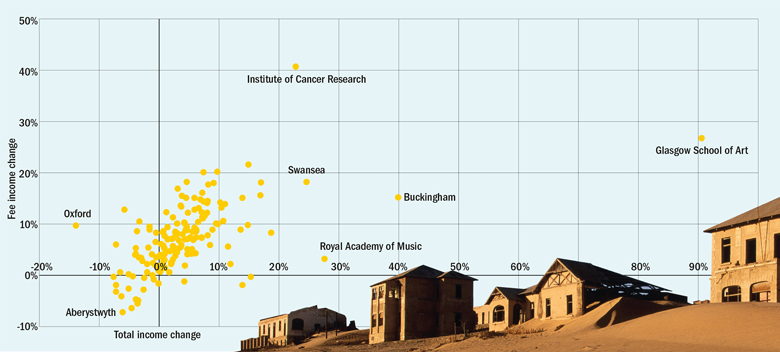

Changing places: relationship between real-terms fee income and total income change, 2014-15 to 2015-16

Source: Hesa

There is a growing list of factors that threaten student demand, sometimes all at the same time. A constant worry over the past few years has been whether a stricter visa policy may turn off the supply of overseas students, and the higher fee income that they represent. A shrinking pool of 18-year-old UK students is also a known issue. But there are two new major threats to add to the list: the teaching excellence framework and Brexit.

The government’s original intention that, in England, only universities with a gold or silver TEF award would be eligible to raise tuition fees by the full permitted amount has been postponed until an independent review of the exercise is complete. However, the TEF’s potential effect on student demand will have some bronze-rated universities in particular watching their application and acceptance rates nervously. And although the metrics underlying the TEF only cover undergraduates – and only partially include overseas students – it is highly likely that demand will be affected across the board by an institution’s TEF rating.

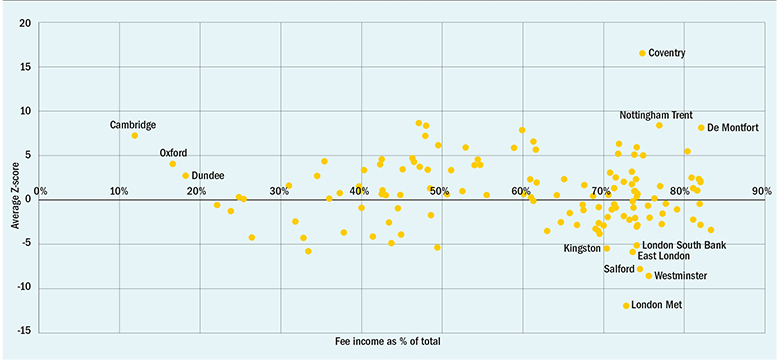

Most worried will be those bronze-rated universities that also have a heavy reliance on tuition fees. Comparing institutions’ proportional income from fees with their average TEF “Z-score” – which shows the average distance they are from meeting their benchmarks on the six TEF metrics: a good proxy for their overall performance – flags up where difficult discussions might be taking place among senior management teams and governing bodies.

Risk factors: institutions’ TEF performance plotted against reliance on fees

Source: Hesa

For Jenny Brown, chief not-for-profit operating officer at Grant Thornton, it is far too early to know how the TEF will affect the sector. But she predicts that it will “really kick in” for universities that were already struggling to stand out from the pack.

“Taking away the student [numbers] cap has been the biggest issue [such universities] have been facing. It raises the question of how they can distinguish themselves to make themselves attractive, and many have chosen to do this by highlighting their teaching and support.”

For other universities, a disappointing TEF score is likely to be less of an issue, particularly if they are a specialist university with a “niche” offer, or one that already has a strong international reputation, such as the London School of Economics. For such global-facing institutions, Brexit and visa policy is likely to be more of a preoccupation.

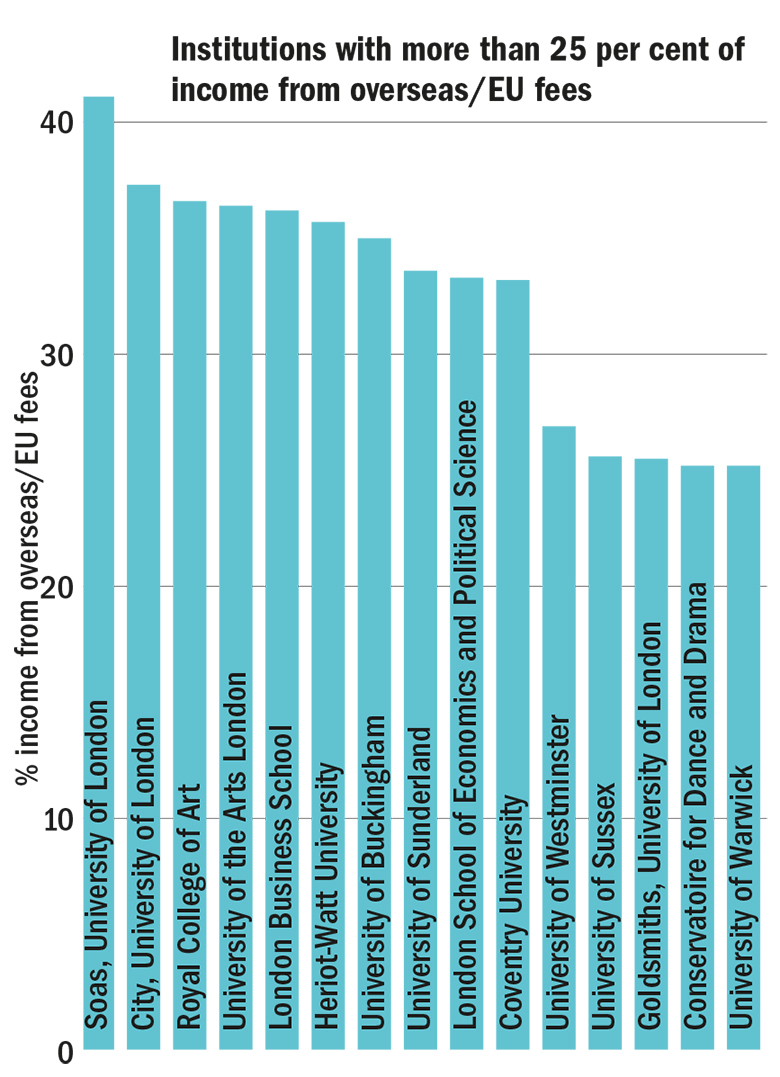

A total of 15 UK institutions, including the LSE and a number of other London universities, have an estimated combined fee income from European Union and overseas students representing more than a quarter of their total income. It is perhaps these universities that will be most concerned with the international student picture. A poor TEF result could amount to a double whammy for those among them that lack the LSE’s reputational gravitas.

Institutions’ reliance on overseas fees

Source: Hesa

As Brown points out, the financial impact of Brexit stretches far further than potential lost fees from EU students. “If universities have a lot of international research and teaching staff there is some nervousness that these are the people who will be lost [due to Brexit],” she says. “So it is not just a [student] demand issue facing universities at the moment: it is a supply issue too.”

The financial knock-on effects of a sudden brain drain of EU staff would be multifaceted. Across the sector, it could hike up the cost of attracting top staff to replace the leavers and diminish the UK’s teaching reputation, hitting international student recruitment further. And, if individual institutions find themselves disproportionately affected by a brain drain, they may also lose ground in the scramble for nationally allocated competitive research grants and see reductions in their research block grants, which are determined on the basis of performance in the research excellence framework.

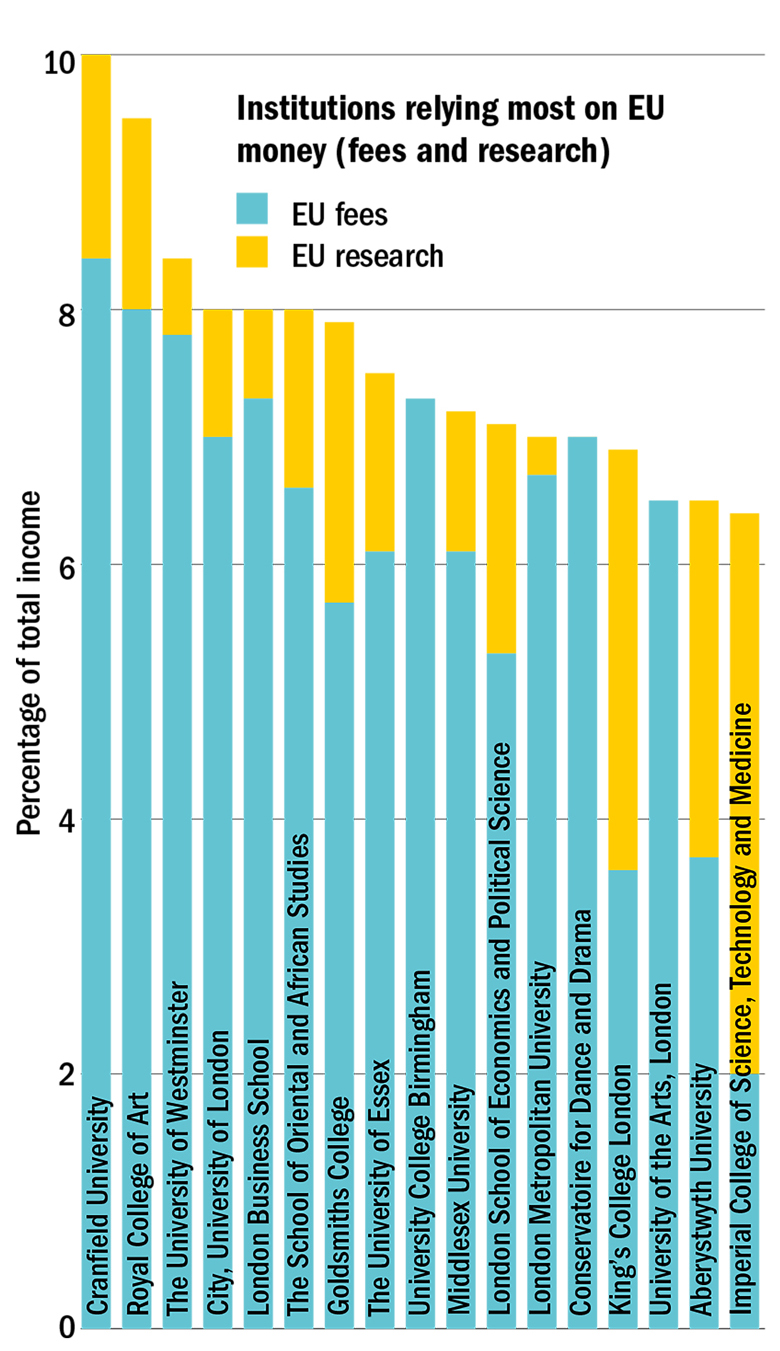

Another Brexit effect could be the shutting down of UK universities’ access to the EU’s research funding programme. When EU student fees and research money are combined, there are relatively few institutions that count on them both for a substantial share of their overall income. However, the raw sums involved are eye-watering for some research-intensive universities. Moreover, for research-focused institutions, the loss of EU grant money and the best EU nationals among their research staff would be a particularly big blow.

Euro zone: reliance on EU cash

Source: Hesa

Phil McNaull, director of finance at the University of Edinburgh and chair of the British Universities Finance Directors Group, says that “it has been clear for some time” that direct income for research “does not cover the full economic cost of conducting it, and the net deficit is subsidised by other sources”, such as surpluses from teaching.

However, he adds, “after several years of capped fees…tuition fees…cannot provide that support; hence the drive by many institutions to [recruit] overseas students”.

The figures on this are stark. According to a presentation made at a conference held by UK higher education’s Financial Sustainability Strategy Group earlier this year, data for 2015-16 show a £3.1 billion shortfall in funding the full economic costs of research across the sector.

Nigel Brown, a former finance director at Hefce who is now an independent consultant on higher education, also points to this shortfall as a concern.

“If an institution starts to fail to recruit [students], it has nothing to draw on to keep [research] going,” he says. Moreover, there is growing pressure to invest any surpluses in more buildings, equipment and facilities, in order to keep attracting students.

The latest bout of political angst about whether universities should continue to be able to charge home undergraduates fees of £9,000 (or £9,250, as the cap will be from 2017-18) is only likely to be ramped up further if students and commentators cotton on that a portion of their fees is subsidising research. Therefore, it is arguably becoming even more important for universities to support academic scholarship from other income sources – especially given the constant threat to income from international fees.

That rationale explains why many universities are eyeing the government’s industrial strategy with interest. Associated funding streams, such as the Industrial Strategy Challenge Fund , aimed at bringing together “the UK’s world-leading research with business to meet the major industrial and societal challenges of our time” are among various alternative sources of income that many universities will have to tap into to remain financially sustainable, according to Deloitte’s Mercer. That is particularly true, she says, for institutions that do not have the option of falling back on their global reputation to buoy up student demand.

“There is a very small number of global brands that are of the scale and reputation to continue to be successful without substantial changes to their strategy and approach,” Mercer says. “It is unlikely that for this handful – and it is a handful – the current uncertainty will have a major impact on them in the medium term. However, for most universities, [it will].”

Another reason why it is paramount that universities diversify their income sources, experts say, is that there are scant opportunities to lessen spending dramatically given that staff costs still represent about half the UK sector’s expenditure.

The ticking pensions time bomb is another major factor: last month’s annual report of the sector’s largest scheme, the Universities Superannuation Scheme, revealed a deficit of £12.6 billion, which the scheme will be required to act to fill. Grant Thornton’s Brown says the major problem with the increasing pensions deficit is that addressing it requires contributions from employers and employees to go up, effectively adding another layer of staff costs on top of general pay rises. Indeed, changes since the last USS triennial review in 2014 mean that any pay increases in the sector already have to factor in that dimension: as Brown points out, higher pension contributions mean staff receive less take-home pay from any increase, and employers have to pay more on top of any pay rise. The only alternative – which has also been adopted – is to make the scheme less generous.

“If you think about it, some of those percentages [of total pay] in terms of employee and employer contributions are so high they are having an absolutely phenomenal effect on pay increases. And pay increases are an incredibly sensitive area,” Brown says.

So which universities have the diverse income streams and lower cost bases that will allow them to best deal with whatever may be thrown at higher education in the next few years?

In the money?: Distribution of surpluses and deficits as percentage of income

Source: Hesa

A look at a university’s surplus or deficit as a percentage of its income gives a few clues. However, these figures can be down to one-off factors that do not always reflect a university’s actual financial position. For instance, the University of Oxford had a deficit of 1.1 per cent of its income in 2015-16, but clearly the institution is not in difficulty and this may be linked to Oxford University Press income being reported only every three years (and not in 2015-16).

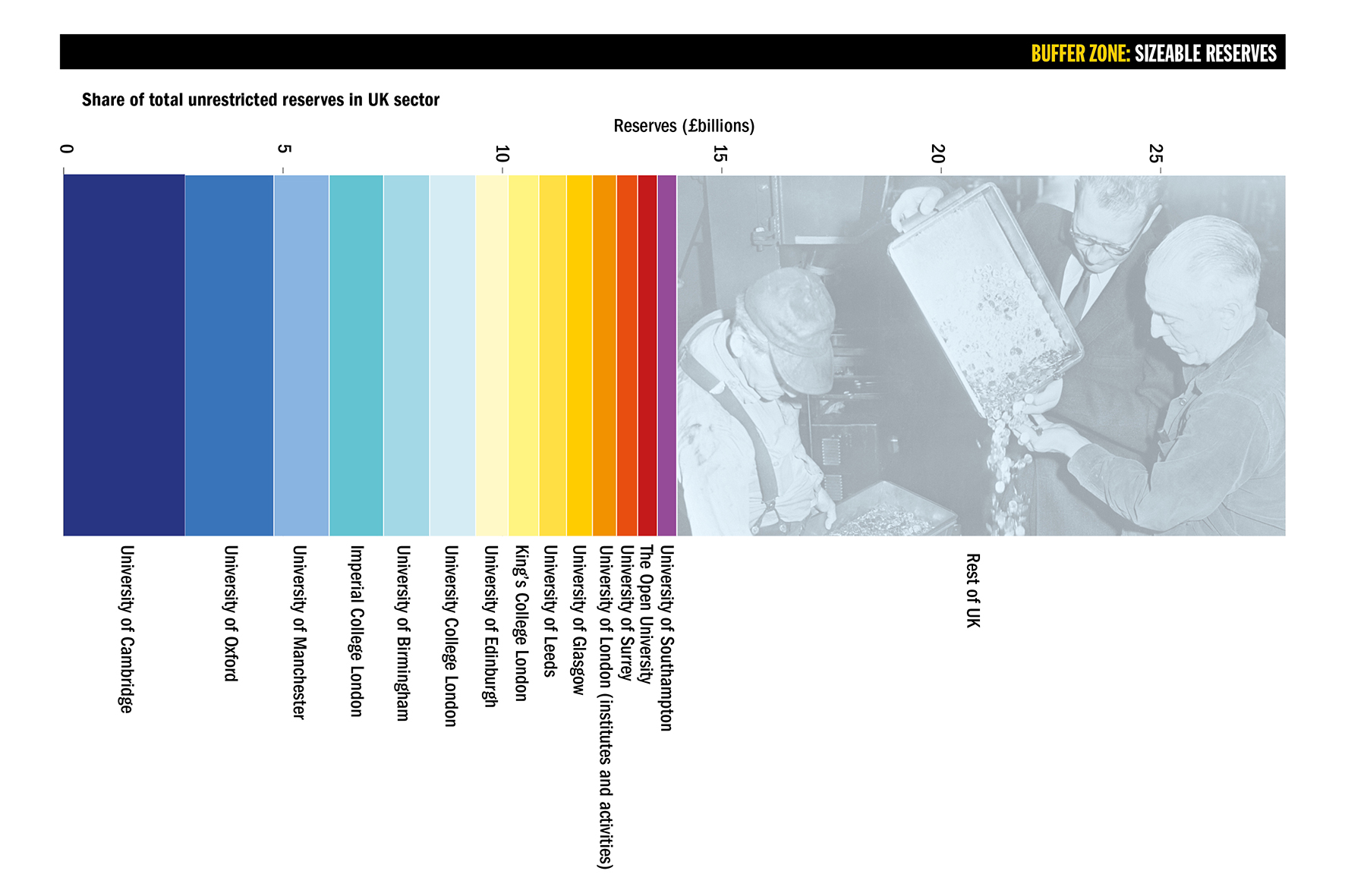

A better indicator, experts suggest, is the state of a university’s unrestricted reserves: the amount of surplus money it has built up and is able to spend on whatever it decides. According to Hefce, “in very broad terms [this figure] can be used as a proxy for the overall value of an institution”.

Source: Hesa

The striking thing about these unrestricted reserves is that just 14 institutions – most of them Russell Group members – hold half of the total reserves for the whole UK sector. In part, this is due to their larger capacity to raise sums from donations, to license intellectual property and charge premium fees to overseas students.

According to Nigel Brown, who was also an adviser to the committee under Lord Dearing that first recommended the introduction of fees in the late 1990s, there have always been a small number of universities able to generate what he calls “free income”. But, 20 years ago, Hefce was able to use its grant allocations to shore up the rest of the sector. These days it – or its successor body – would be able to do little to compensate for sudden changes in fee income at particular institutions. Nor would it be able to compensate for any overall loss of income brought about by a political decision to reduce fees without increasing the teaching grant.

“If anything significant was done to cut undergraduate funding, that would put many institutions at risk. So if you wish to deal with the tuition-fee problem, it has major implications for institutions,” he says.

Grant Thornton’s Brown notes that it is precisely those universities with the biggest reserves that are the least likely to run into the kinds of economic difficulties that would require financial directors to draw on them. And she adds that the socio-economic makeup of their students gives the richest universities an extra advantage.

“It is not just that the wealthy universities stay wealthy,” she says. “It is also that they have the ability to tap into a more wealthy pool of alumni for donations and endowments. [This situation] is not just mirroring society: it is part of the problem.”

Happy returns: the cases of Swansea and London Met

One university that jumps out of the latest financial figures as having a positive story to tell is Swansea University.

It had one of the largest jumps in total income in 2015-16, a real-terms rise of 25 per cent, based in large part on a real-terms rise in fee income of 18 per cent.

For long-serving vice-chancellor Richard Davies, this is the result of a long-term strategy hatched in the early 2000s to grow the institution in terms of research capacity and quality.

“We were rather a small institution [back then]: too small to be cost-effective, [with] no economies of scale [and with] a lot of very small departments that were inefficient and unstable. One person could leave and the whole department would be destabilised,” he says.

So Swansea set about becoming big enough to achieve economies of scale and focused on driving up quality. Success on the latter criterion is demonstrated by Swansea’s performance in the 2014 research excellence framework, Davies says, in which it recorded one of the largest rises in grade point average.

“You recruit students because of [your] quality, at the end of the day. Our growing reputation has given us the chance to recruit more,” he says.

He also points out the importance of having a supportive governing body, which “as long as they were being shown that risks were being properly managed…would go along with really quite bold strategies”.

Meanwhile, at London Metropolitan University, which has had its fair share of financial challenges in recent years, there are hopes that the institution is finally turning a corner. Although London Met was in deficit again in 2015-16, vice-chancellor John Raftery claims that its financial results were £4.8 million “better than forecast”, with “healthy reserves in the bank and no borrowing – which is not something that many universities can claim”.

Although London Met was awarded bronze in the teaching excellence framework, with some of the poorest metrics in the sector, this was based on data going back to 2012. According to Raftery, more recent data on graduate outcomes and student satisfaction point to an improving performance.

“Since 2014, we have put a range of initiatives in place to improve student outcomes, and these are working,” he says. “Our latest graduate employment score is above 45 universities, including several big-hitters in the Russell Group, and we took difficult decisions to redesign our university, including letting people go, which has had a stabilising effect on finances.”

“We believe that financial sustainability follows academic stability, and our new structure is achieving that.”

Simon Baker

Find out more about THE DataPoints

THE DataPoints is designed with the forward-looking and growth-minded institution in view

POSTSCRIPT:

Print headline: Future prospects?

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?