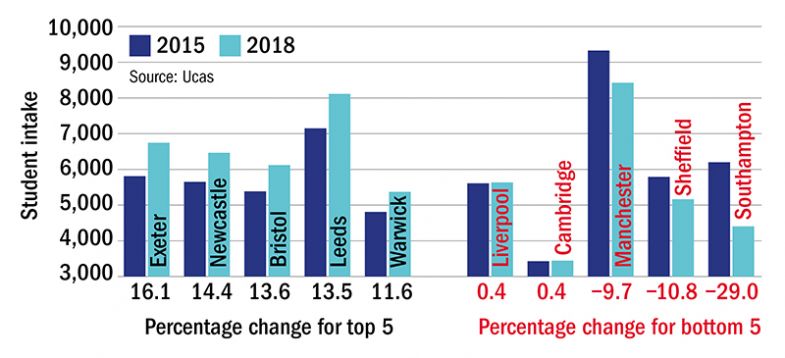

Student recruitment has nosedived at three Russell Group universities since number controls were fully abolished in England, in a sign that the country’s elite are not immune to mounting competition and demographic decline.

The abolition of student number controls in 2015 was known to have had led to big falls in undergraduate enrolment and consequent financial problems at some post-92 universities. But Times Higher Education analysis of Ucas acceptance figures up to 2018 shows that three of the Russell Group’s 20 English members – the universities of Manchester, Sheffield and Southampton – have seen big declines in recruitment too. All three grew under the system of unlimited recruitment of high-grade students, then saw numbers reduced when the cap was fully removed.

While Southampton said that its 29 per cent reduction in student acceptance numbers reflected a strategic choice to raise “quality”, Manchester and Sheffield both explained their falls of about 10 per cent by referring to the new competitive market in student recruitment created by the abolition of number controls.

Among those mounting expansion, the universities of Bristol and Exeter, plus UCL, have long been known to be pursuing growth. However, the rapid growth of around 14 per cent since 2015 at institutions such as Newcastle University and the University of Leeds has not been so widely understood.

Growing and shrinking enrolment at Russell Group institutions

One vice-chancellor said that whereas, in the past, the English sector was a continuum, under the new policy it was divided into something resembling the divisions of English football – and among the “Premier League” of the Russell Group there were several small competitor groups fighting among themselves for students.

Some suggest that a number of Russell Group universities have responded to the new market by dropping their entry tariffs to boost numbers – putting a recruitment squeeze on counterparts that opt not to drop tariffs.

Overall, the average increase in acceptances across the 20 English Russell Group institutions was a modest 2.9 per cent between 2015 and 2018.

Liz Carlile, Sheffield’s head of admissions, said: “In recent years the UK’s demographic dip has meant the number of potential higher education applicants has declined, while the number of higher education providers and post-18 alternatives has risen.

“As a responsible recruiter, we have chosen to admit fewer students in order to maintain our rigorous standards and ensure our students are confident and ready to meet the demands of studying with us.”

The UK’s decision to leave the European Union – which has put pressure on EU student recruitment – and a decline in the population of British 18-year-olds were among the factors cited by Manchester.

“External factors and uncertainties, such as Brexit, plus a change in demographics and more competitive recruitment by universities have all presented challenges and impacted on recruitment over the past few years, but we are able to recruit to overall targets by having a responsive approach to these issues,” a Manchester spokesman said.

Manchester’s non-EU student recruitment increased by 9.8 per cent between 2014 and 2017.

A Southampton spokesman said that the university “has been through a period of transition in recent years, with changes to strategy placing an increased emphasis on the quality of the student experience. The planned reduction of acceptances since 2015 is a reflection of that strategic approach.”

Others at Southampton suggested that the university had pursued a strategy of expansion under former vice-chancellor Don Nutbeam, then abruptly switched to one of higher entry tariffs to secure higher placings in domestic newspaper league tables – which reduced student recruitment – under his successor, Sir Christopher Snowden (now also departed).

Bob Rabone, a former finance director at Sheffield who served as chair of the British Universities Finance Directors Group, said of the general picture: “The diverse range of changes that Russell Group universities have experienced almost certainly says something about their intentions, the reality of their specific positions, a better informed and motivated view from students – all against the demographic downturn in progress. This seems like a perfect recipe for making predicting and [financial] planning even more difficult than before.”

Colin McCaig, professor of higher education policy at Sheffield Hallam University, who has researched the impact of the lifting of number controls, said that “we have seen in recent Ucas cycles since the numbers cap came off that selective institutions have begun to outstrip post-92s in terms of number growth”.

But Professor McCaig also suggested that some Russell Group institutions could be consolidating ahead of the government’s post-18 review, in case it results in a cut in funding per student. Some institutions “may be thinking that incentives for [domestic undergraduate] expansion are no longer there” and “some may decide to expand international or postgraduate student numbers” instead, he said.

POSTSCRIPT:

Print headline: Winners and losers in Russell Group recruitment

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?