In his last political act of 2021, Joe Biden announced he would again extend a two-year freeze on federal student loan repayments. Having previously vowed that there would be no more extensions, the US president’s reversal once more confirmed that the nation’s failed three-decade experiment with student debt is over.

The proponents of student loans still shamble along, recycling the old justifications, but they appear increasingly out of step with a public opinion that rightly reflects the experiences of millions of debt-laden borrowers and their families. The popularity of the repayment moratorium, which will prevent interest from accumulating until at least 1 May, proves there is growing popular and political support for jettisoning student loans and finding a different way to finance US higher education.

This inescapable new reality has come about, in part, because Biden’s extension is no one-off, following a series of recent interventions across the US to end the nation’s dependency on student debt. These include the allocation of billions of dollars by Biden’s administration to allow student debt cancellation, the extension of Public Service Loan Forgiveness to millions of borrowers and proposals for free community college. Meanwhile, universities and state governments have used federal Covid-19 relief funds and their own finances to cancel student debts and eliminate new borrowing by students.

All this marks a distinct about-turn from the early 1990s, when, as I chronicle in my new book, Bankers in the Ivory Tower, Wall Street successfully pushed Congress to expand student loans enormously. Borrowing was largely flat, at about $20 billion (£14.6 billion) annually, throughout the 1980s, but it exploded in the mid-1990s, eventually rising to a peak of just under $120 billion a year in 2010. That followed reforms first put forward by banking representatives via the National Council of Higher Education Loan Programs, which led Congress to radically raise the cap on how much students and their parents could borrow in federal student loans. Income restrictions on who could borrow were also abolished.

The subsequent lending boom was underwritten by the expansion of a “guarantee” subsidy to private lenders, under which the federal government covered the outstanding balance of any loans that students were unable to repay. This taxpayer subsidy was worth about $6 billion a year and guaranteed a profit for lenders, until it was eventually abolished in 2010.

Financiers and their allies promised that this student debt would expand access to higher education and extend its transformative social and economic benefits – without costing anyone anything. As the aptly named William Banks, acting on behalf of the Consumer Bankers Association, told a 1991 Senate hearing, student loans would maintain middle-class access to higher education while reserving federal grant-aid dollars for low-income student access.

This credo was embraced wholeheartedly by colleges, lawmakers and the White House. Accepting the Democratic Party’s nomination for president in 1992, Bill Clinton painted his “vision of our New Covenant”, in which “the doors of colleges are thrown open once again to the sons and daughters of stenographers and steelworkers. We will say: Everybody can borrow money to go to college. But you must do your part. You must pay it back, from your paychecks or, better yet, by going back home and serving your communities.”

The faulty logic of these grand claims is now impossible to ignore, and is driving the growing rejection of student debt. That is because this debt exacerbated the already significant social and racial inequalities in America, while also opening the door to other Wall Street incursions into higher education. At the top, wealthy students or those at prestigious institutions with big Wall Street-managed endowments were able to leave college debt free; last year only 6 per cent of freshmen at Princeton and Yale had any borrowing, while the figure was just 7 per cent at Harvard and Stanford. At the bottom, financiers bought up for-profit colleges to net additional profits off the student loan expansion, yet few of these institutions provided the educational or financial advantages typically enjoyed by graduates. In the middle, public institutions increased student loan borrowing as they were squeezed by the diversion of public subsidies to lenders, for-profit colleges and even endowment investors.

These divergent student debt burdens are apparent if you examine the share of first-year students with zero student debt by institution type. According to data from the Department of Education, about 80 per cent of freshers at the top 30 private universities (using Times Higher Education World University Rankings for 2016) had no college debt, whereas only a little over 20 per cent of those at for-profit institutions had zero borrowing. These students will be repaying their debts for far longer than anyone originally anticipated. And those most likely to face the highest burdens are ethnic minority groups: the average black student borrower still owes 113 per cent of their original debt 12 years after starting higher education, compared with a still high 65 per cent for the median white borrower, reflecting racial inequalities in household wealth and the labour market.

In recent years, the true rationale for the consensus on early 1990s loan changes has become clear. Jane Wellman, then the executive director of the National Association of Independent Colleges and Universities (NAICU), has recounted how it was “explained to me very clearly ‘we’re here to get money out of the bill and the only way there’s going to be money in this bill is in the loan program’”. In the following decades, banks and colleges alike did indeed “get money out of the bill” to expand student loans. But the money was not free. Students and families paid a price, and the least advantaged paid the highest price.

Those leaving the wealthiest institutions have become even more free of student debt in recent years thanks to the university endowment boom. Endowments of several Ivy League schools now top $20 billion, while Harvard’s endowment surpassed $50 billion in 2020.

This unprecedented endowment wealth has been amassed with crucial assistance from the private equity and hedge fund titans of Wall Street. Using newly deregulated financial engineering and tax avoidance techniques, these funds tended to outperform conventional investment funds over the long term. Early investment in private equity and hedge funds helped Harvard, Princeton and Yale earn a 10 per cent average annual rate of return from 1980 onwards. Meanwhile, schools with endowments of less than $100 million tended to have return rates just a little more than half of that.

Financial fund managers play a further part by making large donations to top private universities that they typically attended; 65 per cent of the fund managers who ranked among the 400 wealthiest Americans in 2017 had bachelor’s degrees from one of the top 30 private universities, mostly from the Ivy League. While it is difficult to fault anyone who gives away millions of dollars to educational causes, it is worth noting that relatively few students benefit from such gifts as elite private universities enrol few undergraduates in total and fewer still who need financial aid to attend college debt free. Famously, the University of California, Berkeley has in recent years enrolled almost as many low-income undergraduates as the entire Ivy League combined.

While private equity investors helped shield students from debt at their alma maters, they also made less advantaged for-profit college students the primary test subjects in the grand student debt experiment. Following the early 1990s trend of federal student loan programmes, private equity investors acquired 88 for-profit college companies to profit from debt-financed tuition growth. Private equity then capitalised these chains to expand, ultimately resulting in just under 1,000 colleges operating under private equity ownership. Twenty of the most successful chains were subsequently listed for sale in the first initial public offerings in the sector.

This private equity invasion led for-profit college enrolments to quadruple, from just over 500,000 in the 1990s to a peak of 2.7 million in 2011. More than a million of those students were enrolled at companies owned or taken public by private equity. As a result, for-profit colleges went from enrolling 5 per cent of all US undergraduates in the 1990s to 12 per cent by the end of 2010.

As they grew, for-profit colleges disproportionately enrolled low-income and black students. At their peak in 2011, for-profit colleges enrolled 18 per cent of all black undergraduates, more than the combined enrolments of all private non-profit colleges. That year, for-profit colleges enrolled 42 per cent of all students with low enough incomes to receive federal Pell Grants, more than even public universities and community colleges.

The results among for-profit college students ranged from costly to devastating. To net larger profits, investors provided woefully inadequate funding for instruction, while spending heavily on marketing and recruitment. The graduation rate from four-year degree programmes averaged just 28 per cent under publicly traded college companies and just 39 per cent under private equity-owned colleges. A 2016 audit study found that employers were no more likely to call back a job applicant with a for-profit degree than someone with no degree at all. As a result, just 44 per cent of students at investor-owned colleges were able to pay down even a single dollar of their debt within three years after they were required to begin repayment.

With their credit ruined and a costly new loan to repay, nearly 400,000 former students from for-profit colleges filed borrower defence fraud claims by the end of September 2021. The claimants requested to have their debts cancelled because their colleges misrepresented the likely earnings and employment benefits of their programmes when signing them up for federal student loans. The Biden administration has so far cancelled over $1.2 billion in student loans for more than 115,000 of these borrowers.

While for-profit college students suffered the most crushing debts, the largest group to take on loans was public university students. Wall Street played another distinct role in this particular sector by capturing tax revenue that previously would have gone to public universities. Public institutions, in turn, used student loan-financed tuition, room and board to offset lost taxpayer funding.

Public universities are the massive middle of the US higher education system, conferring 62 per cent of bachelor’s degrees in recent years. While still beset by persistent racial and class inequalities, more selective public universities enrol a much more economically diverse student body than their elite private counterparts. As public universities increased tuition, room and board prices in place of taxpayer funding, increasing shares of these working- and middle-class students turned to the expanded federal loan programme.

In the 1970s, only 13 per cent of all college students borrowed, with the proportion at public universities lower still. However, the proportion of public university undergraduates who borrow reached 42 per cent in 2001 and 52 per cent in 2015. And while these borrowers repay more than their for-profit college counterparts do, less than 50 per cent of low-income borrowers at public universities manage to repay even $1 of their loan within three years of leaving.

The extent to which Wall Street has diverted taxpayer funding away from public universities should also not be underestimated. Private equity and hedge funds took off in the 1980s in large part because of cuts to capital gains taxes, with fund managers using this interest loophole to reduce their federal income tax liability by around half, or $180 billion annually. They also pressure the companies they own to increase tax avoidance. Lax Internal Revenue Service enforcement for corporations and wealthier taxpayers, who are disproportionately investment bankers and finance professionals, reduces federal tax revenue by $100 billion a year alone.

Unsurprisingly, university endowments have benefited from many of the most arcane tax avoidance practices, such as indirect tax arbitrage via municipal bonds for capital projects and offshore tax blocker corporations. One study found that endowments receive $20 billion in tax subsidies annually. For perspective, this money, plus the $10 billion provided in Pell Grant spending to for-profit colleges, could double the Pell Grant awards to low-income students at public universities. Alternatively, by doubling the current average annual grant of $4,160 per Pell recipient, it could make college in effect debt-free for millions of beneficiaries.

Reform of federal student loans by the Obama administration in 2010 demonstrates that tax and direct subsidies to Wall Street can be redeployed to reduce student debt. Congressional legislation eliminated the $6 billion annual guarantee subsidy to non-government lenders and used $3.6 billion of the savings for the largest increase in Pell Grants since the 1970s. This shift towards student loan borrowing is now gaining momentum.

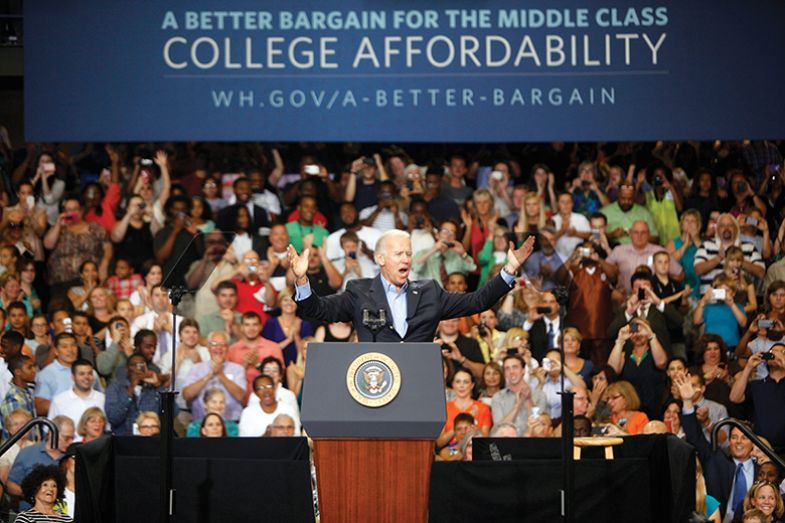

Student debt is creating growing inequity in US society

It is difficult to anticipate how long it will take to unwind the US student loan system. But political pressures seem aligned in that direction – with student debt opponents successfully pushing the case for incremental reductions of debt until a policy for complete elimination is found.

The new political consensus is clear. It is impossible to imagine any politician today promising a Clintonesque fairytale given that there are now 42 million Americans with student debt, and tens of millions more family members who know the struggles of debtors. They have lived how student debt prevents working-class and especially black Americans from owning homes or building household wealth in the same way as those who leave college debt-free can do. As a result, 67 per cent of voters support at least some amount of debt cancellation, including strong majorities of black, white, Democratic, Republican and independent respondents.

Debt cancellation supporters, such as Senator Elizabeth Warren, Congresswoman Ayana Presley and Senate majority leader Chuck Schumer, have also clarified policy mechanisms for eliminating student debt. All three insist federal student debt could simply be cancelled by a presidential executive order, without any congressional approval. Both Donald Trump and Biden were unchallenged when they exercised this executive authority to extend the student debt moratorium originally put in place by Congress; this, in effect, cancelled more than $100 billion in unaccrued interest for all borrowers by the end of Biden’s latest extension. Incremental reforms to public service loan forgiveness, income-driven repayment plans, and borrower defence are welcome, but it is surely only a matter of time before Biden, or another future president, uses executive authority to cancel most, if not all, outstanding student loan balances.

Such a move, of course, would then raise the question: “Why should we make future students borrow in the first place?” But making college debt-free for future borrowers will prove trickier. Beyond the Ivy League, large leaders of public university systems, such as Ohio State and the University of California, have declared their ambitions to become debt-free. Their visions involve using tuition from wealthier students to subsidise students who would otherwise borrow. To become truly debt-free, however, they will probably need more financial support from the federal government. Raising taxes on Wall Street and the wealthy is the obvious source of the required extra revenue, but this will require Congressional action.

In the past year, Biden, Warren and their allies have come close to advancing legislation that would harness higher corporate and wealth taxes to make community college free. The Democrats’ razor-thin majority in Congress however, appears to have thwarted this project for the duration of Biden’s first term. A wholesale transition to debt-free college may have to wait for the next trifecta of Democratic control of the presidency and both houses of Congress. But when this eventuality occurs, student debt opponents will be more ready than ever to end Wall Street’s failed student debt experiment once and for all.

Charlie Eaton is assistant professor of sociology at University of California, Merced. He is also affiliated faculty at University of California, Berkeley’s Center for Studies in Higher Education. His new book, Bankers in the Ivory Tower: The Troubling Rise of Financiers in US Higher Education, is published by University of Chicago Press in February.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?