US higher education is rejecting a Trump administration call to remove China-based companies from its institutional endowments, deriding the idea as an inexplicable imposition on academia.

US colleges and universities have long tried to balance the Trump administration’s general hostility toward foreigners with its more plausible warnings about China-specific security threats.

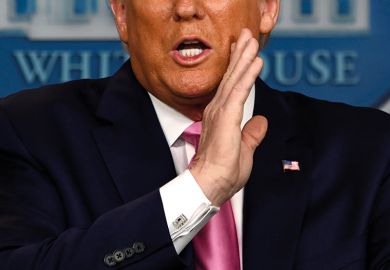

But a letter sent to US universities by US State Department official Keith Krach, saying that their endowment managers “would be prudent to divest from” stocks in China-based companies, has hit a wall.

Mr Krach, the undersecretary of state for economic growth, energy and the environment, offered no reason why universities alone should face such a request, noted Terry Hartle, senior vice-president for government and public affairs at the American Council on Education, the main US higher education lobby group.

“As long as the financial instruments from China are so readily available on the US financial markets,” Dr Hartle said, “investors, including universities, will probably continue to hold them.”

At Harvard University – with an endowment of $40 billion (£30 billion), the world’s largest – the bottom-line effect of Mr Krach’s request was likely be “virtually none”, said William Kirby, a professor of China studies.

Even if Harvard’s endowment managers took the request seriously, said Professor Kirby, the chair of Harvard’s academic venture fund for China, few or no portions of it could be tied to individual Chinese stocks.

Instead, Professor Kirby said, virtually any Chinese portion of Harvard’s endowment comes through funds with a varying mix of companies,

“The brush is so broad,” he said of Mr Krach’s suggestion, “as to be a kind of intimidation on the part of the government, by an administration that has not shown any capacity for nuance in dealing with China.”

In his letter to the universities, Mr Krach recited a list of oft-stated Trump administration complaints about Chinese political and economic behaviours.

He then described an ongoing administration-driven regulatory process that could lead to Chinese companies being removed from US stock markets by the end of next year, and warned universities that they might want to avoid the risks of remaining invested in them.

Asked why Mr Krach was directing the suggestion solely to US universities, a State Department spokesman cited a letter that Mr Krach sent last month to US business leaders warning them to avoid vendors that may be using forced labour in the Xinjiang region of China.

Such letters, the spokesman said, were aimed at “shining a light on the Chinese Communist Party’s threats to multiple US sectors”.

Foreign investments from all countries account for about 14 per cent of the holdings in US college endowments, according to the National Association of College and University Business Officers.

Focusing on university endowments, out of more than $700 billion in annual US-China trade, may be more about academia than foreign policy, Professor Kirby suggested. “Universities, under this administration, have been a kind of special battleground in the field of US-China relations,” he said.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?