The State of the Nation, co-written by the association with analysts at Ernst and Young, presents a “new positive mood” in UK bioscience in the wake of the global economic crisis.

According to the report, the UK has the largest pipeline of products of any biotech cluster outside the US - behind just New England, the San Francisco Bay area and San Diego - and is the best place for raising innovation capital in Europe.

It also boasts that the UK has six of the world’s “top 50 universities for clinical, pre-clinical and health research”, apparently referring to the Times Higher Education World University Rankings 2012.

Released at the association’s UK Bioscience Forum in London on 10 October, the report also says that government-backed models, such as the biomedical catalyst and regional growth fund, have played “a big part in catalysing investment in the UK” while venture capital has been constrained.

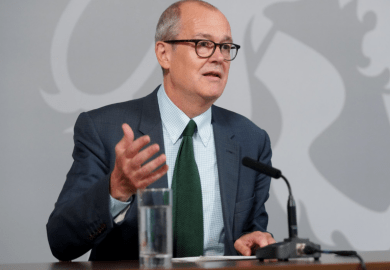

However writing in the introduction, Ian Oliver, executive director at Ernst and Young, adds that there are “few, if any, signs” that UK investors are ready to support biotech businesses floating on the stock market.

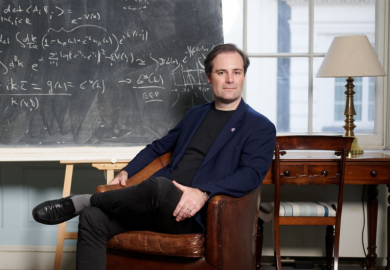

His sentiments were backed up by Andrew Jack, pharmaceuticals correspondent for the Financial Times, who speaking at the event said it was important “to caution against hype, and over optimism, also against complacency and even, dare I say it, increasingly perhaps, nationalism”.

“I think we’ve got to look global much more than country by country,” he added.

The ability to move beyond early stage academic research and start-ups to large enough bodies of experienced executives capable of taking companies to the next stage was still an issue, as was the gap in funding to do so, he said.

He also highlighted how big pharmaceutical companies had restructured and narrowed their focus in the UK, and commented that other countries had similar government incentives to invest.

“Internationally, if I were an entrepreneur or funder with a global choice I’m still not entirely convinced the UK would be my first port of call, if there weren’t other historical reasons for being here,” he said.

Meanwhile on the same day the University of Cambridge launched a £50 million investment business to support the development of university spin-outs and other early-stage technology companies around the city.

Cambridge Innovation Capital, backed by funding from Invesco Perpetual and Lansdowne Partners, as well as the university’s endowment fund, ARM Holdings and IP Group, is intended to help companies “bridge the critical middle stage of commercial development”, said the university in a statement.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?