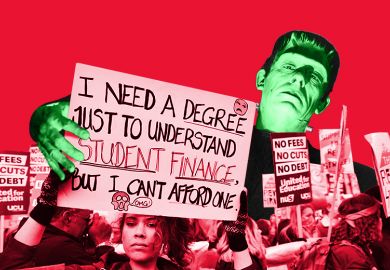

The government’s plan to freeze the student loan repayment threshold will cost the average borrower an extra £2,800, with women and graduates from poorer backgrounds being disproportionately affected.

That is according to the Sutton Trust, which is calling for the proposals – which would fix the salary at which graduates are required to start repaying their loans at £21,000 for five years – to be dropped. The government had previously said that the threshold would be increased “periodically” in line with average earnings.

In an analysis published on 24 September, higher education consultant John Thompson, who prepared the report for the trust, says that the reforms – announced in the July Budget and now under consultation – will cost graduates of English universities an additional £2,800 over the 30-year repayment period.

Women would be disproportionately affected by the changes, set to be introduced in 2016, because they tend to earn less than men. Mr Thompson said that men would repay an average of £37,100 over three decades, an increase of £2,300, while women would pay an average of £29,700, up £3,300.

If the government were to continue the freeze beyond 2021, the impact could be even greater.

The report adds that the situation could be exacerbated further by the government’s decision to scrap maintenance grants and replace them with loans from 2016-17 onwards.

The overall increase in repayments for grant-eligible students would be £3,000, but with a salary threshold freeze, this increases to £7,000, the report says.

Even bigger risks arise, the report says, from the impact that retrospective changes to borrowing terms could have on the willingness of future students to enrol in higher education.

An analysis published in July by the Institute for Fiscal Studies warned that the Budget would see the poorest 40 per cent of students in England leave university with debts of up to £53,000.

In addition to the dropping of the current proposals, the Sutton Trust recommends that new borrowers be given definite terms for the entire repayment period, and also that the thresholds for repayment and maximum interest be set in terms of a percentage of average earnings.

Sir Peter Lampl, the charity’s chairman, said there was still time for the government to drop “this particularly unfair measure”.

“Freezing the repayment threshold for student debt will add to graduates’ already heavy financial burden,” he said. “The fact that this measure will adversely affect low earners and graduates from low-income homes, who are already being penalised by the Budget shift from grants to loans, is a serious cause for concern.”

The consultation on the threshold change, which would save the government an estimated £1.4 billion on each student cohort, is still under way.

A spokesman for the Department for Business, Innovation and Skills said: “We want our world-class higher education system to remain financially sustainable and welcome responses to our current consultation on the threshold for student loan repayments. Our reforms to student finance will mean that students from low-income backgrounds receive a substantial increase in cash-in-hand to help with living costs whilst at university.”

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?