Changes to student loans after 2012, principally the freezing of the repayment threshold, have increased the “burden” of repayments “most for low and middle earners”, according to a new Institute for Fiscal Studies report.

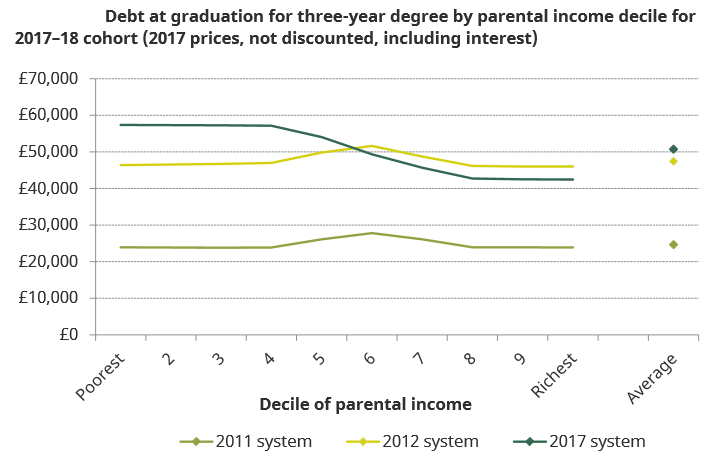

The IFS also says that the Conservative government’s decision to abolish maintenance grants for the poorest students from 2016, replacing such funding with loans, has left students from the poorest 40 per cent of families “graduating with the largest debts: around £57,000 on average, compared with around £43,000 for students from the richest 30 per cent of families”.

The IFS adds: “This pattern was not a feature of the 2011 or 2012 systems, under which debt is broadly flat across the parental earnings distribution.” Graduates from English universities have the “highest student debts in the developed world”, the report says.

The report, titled Higher education funding in England: past, present and options for the future, is written by Chris Bellfield, Jack Britton, Lorraine Dearden and Laura van der Erve.

Tuition fees are once again a hot political issue, in the wake of the impact that Labour scored with voters with its election pledge to abolish fees and reintroduce maintenance grants.

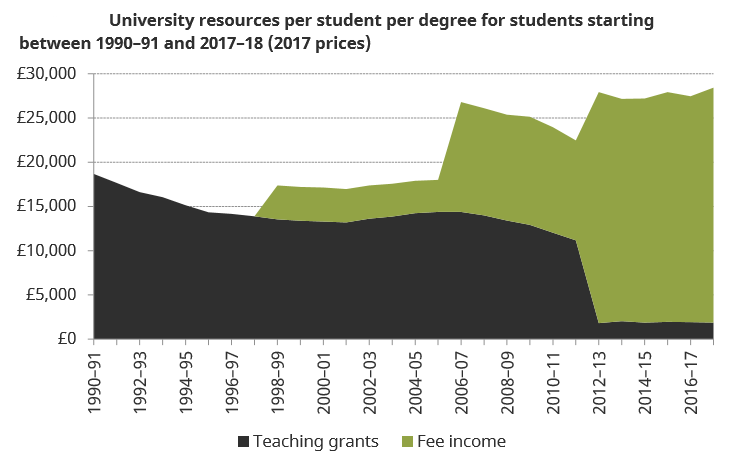

The IFS report looks at the impact of changes to higher education funding made by the coalition government in 2012, when fees were trebled to £9,000 and direct public funding slashed, and after that in a number of changes to the loans system made by the last Conservative government, principally the abolition of maintenance grants and the freezing of the loan repayment threshold at £21,000 (which the government originally said would be raised in line with earnings).

The switch to fee-based funding in the 2012 changes brought universities a 25 per cent increase in per student per degree funding in 2017 prices, the report finds.

But there were proportionally greater per-student income increases for classroom-based subjects than for more costly subjects in science, technology, engineering and mathematics, the authors state. Per-student income in “Group A” high-cost subjects rose by 6 per cent between 2011 and 2017, while in “Group D” low-cost subjects it increased by 47 per cent, they find.

While universities may be reallocating funds to cross-subsidise subjects, “these funding changes appear to be at odds with the government’s intention to promote typically high-cost STEM subjects”, the IFS suggests.

It says that reducing tuition fees or reintroducing maintenance grants could allow the government to “target specific students or courses that have wider benefits for society”, although this would increase deficit spending.

The report also says that the main beneficiaries of reducing fees “would be high-earning graduates, as they are the ones making the highest repayments under the current system”.

“The long-run taxpayer contribution has become considerably more uncertain” in the switch to a loans-based system and is reliant on fluctuations in graduate earnings and the government’s cost of borrowing, the report says.

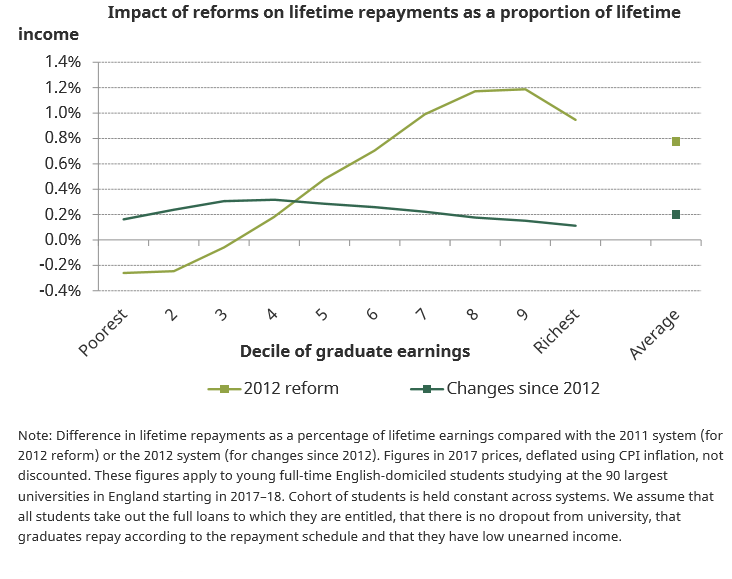

Changes made after 2012 “have increased the repayments of almost all graduates, increasing the burden of student loans the most for low and middle earners – driven largely by the freezing of the repayment threshold”, the IFS also says.

The changes since 2012 “have increased repayments as a proportion of lifetime earnings the most among graduates in the third and fourth deciles of earnings” (those towards the bottom of the earnings scale), the authors state.

The IFS notes that the poorest students now have slightly more “cash in pocket” with maintenance funding switched to loans.

And the level of graduate “debt” is ultimately less significant than the amount graduates repay. As the IFS estimates, 77.4 per cent of graduates will have some debt written off at the end of the repayment period, up from 76 per cent under the 2012 system and 41.5 per cent under the 2011 system.

But the authors nevertheless warn about the potential impact of headline “debt” levels as well as the burden of repayments in their conclusion, in which they argue that “there remain major issues with the system”.

“First, although we have yet to see large declines in student numbers, the long-run cost of university is now considerably greater – both in terms of debt on graduation and in terms of long-run repayments – for prospective students, and this may reduce participation in the longer term,” the authors say.

“Second, the current system does not give the government much flexibility to directly target courses or individuals that have high value to society.”

The coalition government slashed direct public funding and replaced it with loan funding (loans do not contribute to the deficit until written off, but have a longer-term impact on government finances by adding to the national debt). The IFS adds in its conclusion that “reducing tuition fees or bringing back maintenance grants would have the advantage of allowing government to target specific students or courses that have wider benefits to society.

“This would, however, significantly increase deficit spending and lead to a smaller, but still considerable, increase in the long-run government contribution. In future years, the government should put more weight on the latter than the former in its approach to making policy.”

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?